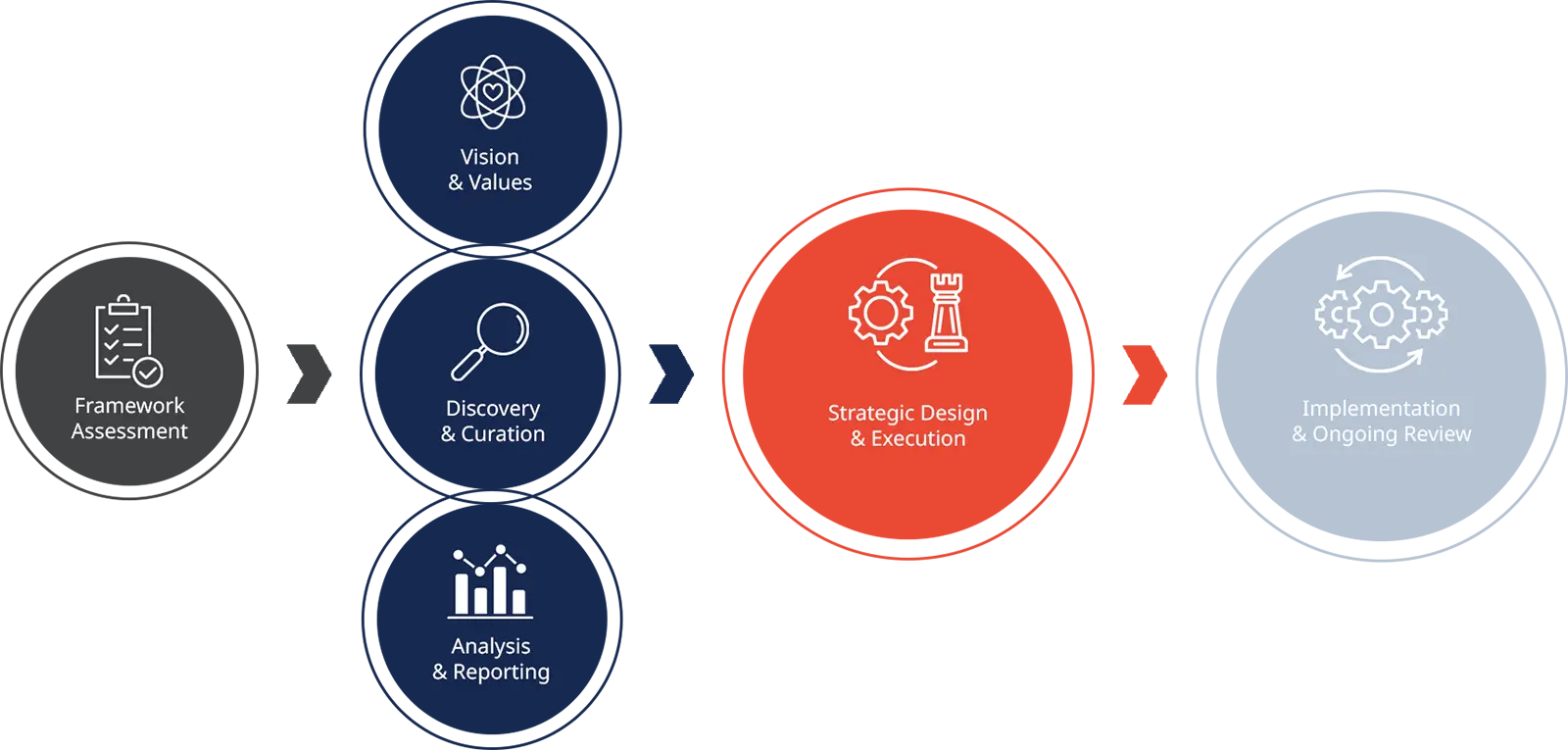

A Framework for Success

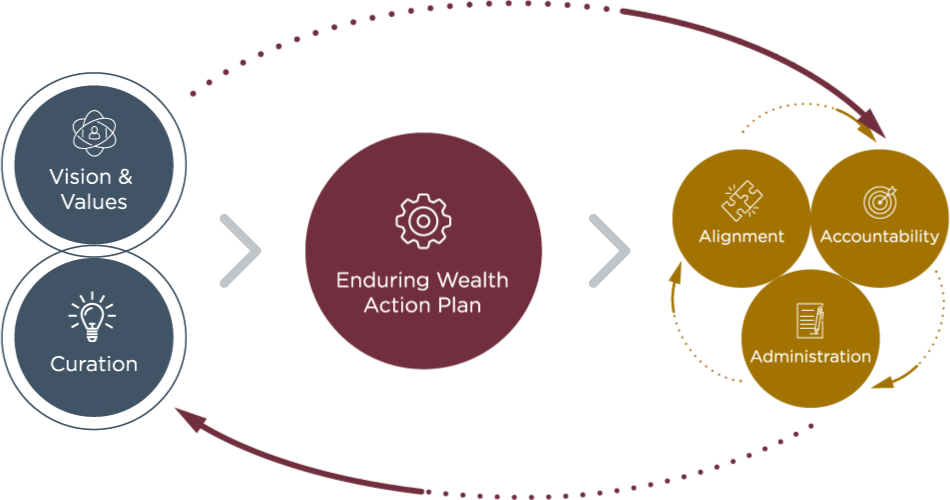

At Balefire, we offer more than financial strategies—we offer a structured, proven framework designed to bring clarity, confidence, and continuity to your wealth plan. We invest in partnership, not just planning.

We help you align your financial resources and decision-makers with the values and vision that matter most. From there, we help you design a forward-looking strategy—one that’s transparent, adaptable, and built to last.

- Proactive by design – We stay ahead of legal and regulatory changes to help you seize every opportunity.

- Truly Collaborative – Your goals shape the plan; our expertise brings it to life.

- Principled in approach – We align wealth with purpose through open, honest dialogue to create lasting legacies.

Redefining Wealth

We define enduring wealth as the purposeful integration of four essential cornerstones: financial, generational, entrepreneurial, and influential capital. Our forward-thinking, values-based approach aligns your financial strategy with what matters most—your vision, your relationships, and the impact you hope to make across generations. We believe true generational wealth empowers independence within the family, not dependence on it, and we guide families in building stewardship practices that are built to last.

When spending money feels uncomfortable, adopting a stewardship mindset assigns purpose to your finances, which can be measured by “How much is enough for now?” and “How much is enough for the future?” We calculate the total amount of money and assets accumulated separately from business entities that must be safeguarded to secure the family’s lifestyle and endow financial freedom.

- Investment philosophy

- Use, freedom, and enjoyment

- Estate Plan

The ultimate measure of legacy is living with intention and investing in the next generation’s success. At Balefire, we place equal weight on financial wealth and familial health—calibrating a family’s current needs and values with the dreams and intentions of their successors, while considering how those contributions will be preserved long after they’re gone.

- Healthy family dynamic

- Vision and values

- Protect and preserve strategy

Company ownership or entrepreneurship is often the economic engine that creates a family’s wealth. We work with our clients to evaluate operating entities for strategic and tactical readiness. This includes plans for succession, liquidation, transition, talent acquisition and retention, or sale events as part of the overall wealth profile.

- Enterprise value

- Alignment and empowerment

- Transfer plans

We view generosity and giving as much more than a routine financial transaction. It’s a meaningful opportunity to create a lasting impact in the lives of others. We help our clients discern the type of issues or causes they want to support, how to achieve their generosity goals, how involved they want to be with their supported causes, and even the structure and cadence of giving.

Separate from financial generosity, we also evaluate relational generosity. This includes the family’s reputation in their community, employee engagement, and their personal brand in their circles of influence, including heirs.

- Family impact plan

- Vision for giving

- Reputation

Start the Conversation

We take a thoughtful, personalized approach to connect you with the right advisor. Schedule a brief call to explore how Balefire can help you move forward with clarity and confidence.

"*" indicates required fields

By clicking “Submit”, you acknowledge that we collect your name, email address and phone number to respond to your inquiries and provide you information about our products and services in accordance with our Privacy Policy. If you are a California resident, please see our CCPA Notice to California Residents.